Tell The IRS To Stop Its Facial Recognition Plans

361 signatures toward our 30,000 Goal

Sponsor: The Veterans Site

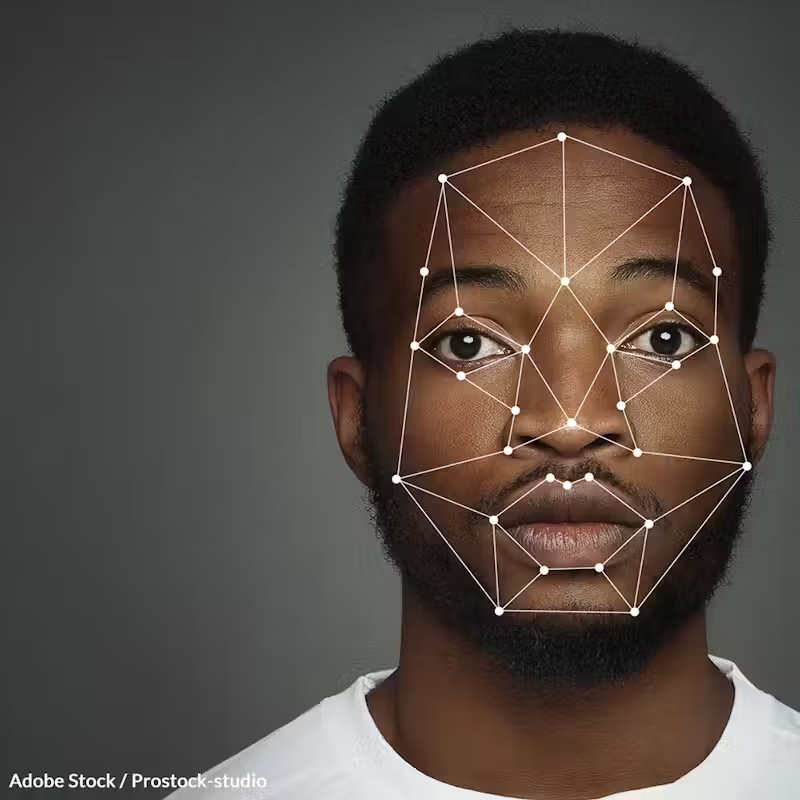

Facial recognition systems are not only invasive, but capable of misidentifying individuals. Take a stand!

The IRS announcement that taxpayers would be required to submit to facial recognition technology just to access their tax information was met with swift outrage from the public and both sides of Congress1.

Critics argue that facial recognition is not only an invasion of privacy, it is unreliable. Previous facial recognitions systems have been linked to racial and gender biases, showing difficulties accurately identifying women and people of color, in some cases misidentifying an individual as a completely different person2.

The IRS subsequently suspended its contract with facial recognition vendor ID.me, but there is nothing stopping the department from reinstating the same contract, or another with a different vendor3.

Without regulation, the IRS plan could snowball to many government agencies using commercial facial recognition companies to get around regulations that were put in place specifically to rein in government powers4.

The No Facial Recognition at the IRS Act, introduced by Senators Roy Blunt and Jeff Merkley will ban the IRS from using, or contracting to use, biometric recognition technology5. It would also give the IRS 60 days from when the bill is enacted to delete all biometric data collected by the IRS or any company the IRS has been working with to collect the data.

This bill has garnered bipartisan support in an otherwise deadlocked congress, a clear justification for its importance to the American people.

No taxpayer should be subject to this intrusive and frustrating system just to access their tax information online. Especially when the technology itself has the potential to compromise personal data.

Sign the petition and tell Congress you support The No Facial Recognition at the IRS Act!

- Rachel Metz, CNN Business (28 January 2022), "The IRS website will soon require facial recognition to log in to your account."

- Taylor Kay Lively, ASIS International (1 December 2021), "Facial Recognition in the United States: Privacy Concerns and Legal Developments."

- IRS, (22 February 2022), "IRS announces transition away from use of third-party verification involving facial recognition."

- James Hendler, The Conversation (1 February 2022), "Government agencies are tapping a facial recognition company to prove you're you — here's why that raises concerns about privacy, accuracy and fairness."

- Sen. Jeff Merkley, 117th Congress (2021-2022), "S.3668 - No Facial Recognition at the IRS Act."

The Petition:

Dear Senators Roy Blunt and Jeff Merkley,

Your continued efforts to pass The No Facial Recognition at the IRS Act are essential to the protection of American freedoms, and I fully support this measure.

Facial recognition is not only an invasion of privacy, it is unreliable. Previous facial recognitions systems have been linked to racial and gender biases, showing difficulties accurately identifying women and people of color, in some cases misidentifying an individual as a completely different person.

Without regulation, the IRS plan could snowball to many government agencies using commercial facial recognition companies to get around regulations that were put in place specifically to rein in government powers.

No taxpayer should be subject to this intrusive and frustrating system just to access their tax information online. Especially when the technology itself has the potential to compromise personal data.

Thank you for your continued efforts to pass the The No Facial Recognition at the IRS Act!

Sincerely,